You can transform lives for years to come — by creating a charitable gift annuity with City of Hope®.

How a Charitable Gift Annuity Works

- A Gift of Hope for City of Hope Patients. Your gift ensures City of Hope’s groundbreaking research and compassionate patient care will continue uninterrupted, regardless of what’s happening in the world.

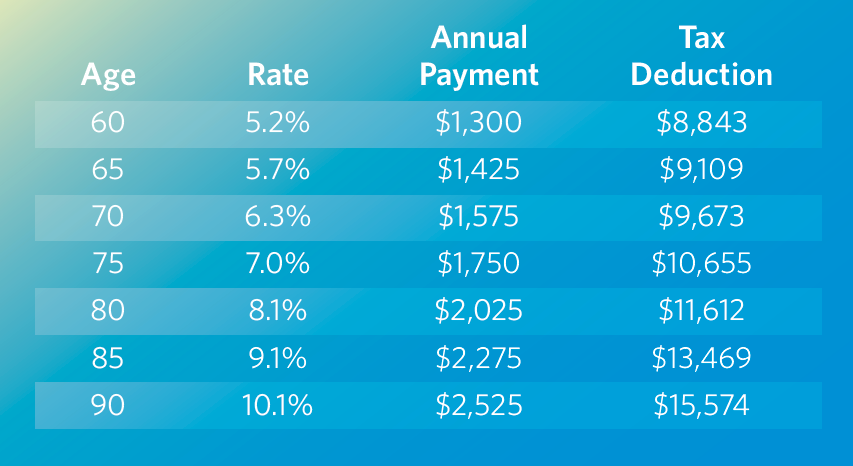

- Attractive Payment Rates. Depending on your age, rates go as high as 10.1%. You can benefit up to two people and provide financial security for yourself and a spouse or other loved one. You each receive payments for your lifetimes.

- Rates Can Be Even Higher. If you’re not sure when you would need your payment to start, a flexible deferred charitable gift annuity allows you to decide later. The longer the deferral, the higher your payment rate.

- Lower Taxes. With a charitable gift annuity, you are eligible for an income tax deduction and a portion of your payments is typically tax-free.

- Fixed, Guaranteed Payments. The fixed payments from a charitable gift annuity can help balance equity risk in your portfolio. Your payment will never change and are backed by the full assets of City of Hope.

New Higher Charitable Annuity Rates*

*Rates as of January 2024. Based on one beneficiary and a gift of $25,000 (our minimum gift amount). All examples are for illustration purposes only. Your rates may differ. For Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department.

*Rates as of January 2024. Based on one beneficiary and a gift of $25,000 (our minimum gift amount). All examples are for illustration purposes only. Your rates may differ. For Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department.

Request a downloadable copy of our complimentary publication about charitable gift annuities using the form on this page.

Frequently Asked Questions

Q: I am 70.5 or older. There is news that I can now fund a charitable gift annuity with a Qualified Charitable Distribution (QCD) from my IRA. How can I do that?

A: Under the provisions of the Secure 2.0 Act, signed into law on December 31, 2022, as part of the federal omnibus spending bill, donors age 70.5 or older may take a one-time qualified charitable distribution to fund a charitable gift annuity. There are a few differences between annuities funded with a QCD and those funded with cash or appreciated securities:

- This is a one-time opportunity. While you may continue to direct QCDs to your favorite charities in any year, you may only fund a gift annuity with a QCD in one tax year.

- You may only give a total of $53,000 to fund charitable gift annuities, across all charities. However, you may still make up to $105,000 in total QCD gifts in a year, as long as not more than $53,000 funds a charitable gift annuity.

- The entire gift annuity payment will be taxable as ordinary income. When a gift annuity is funded with cash or securities, some of the annuity payment will not be taxed.

- A gift annuity funded by a QCD can only benefit the donor and/or the donor’s spouse.

- You may not defer payments more than one year.

- There is no charitable deduction available, although your QCD amount is still excluded from your adjusted gross income.

Q: Is there a minimum age or donation amount required to establish a City of Hope charitable gift annuity?

A: City of Hope requires a minimum donation of $25,000, although it is not uncommon to contribute $105,000 or more. You must be age 60 or older to establish a charitable gift annuity with us. Younger donors may be able to establish a deferred charitable gift annuity. If you are looking ahead to retirement, you can delay the start of payments and realize a higher payment rate.

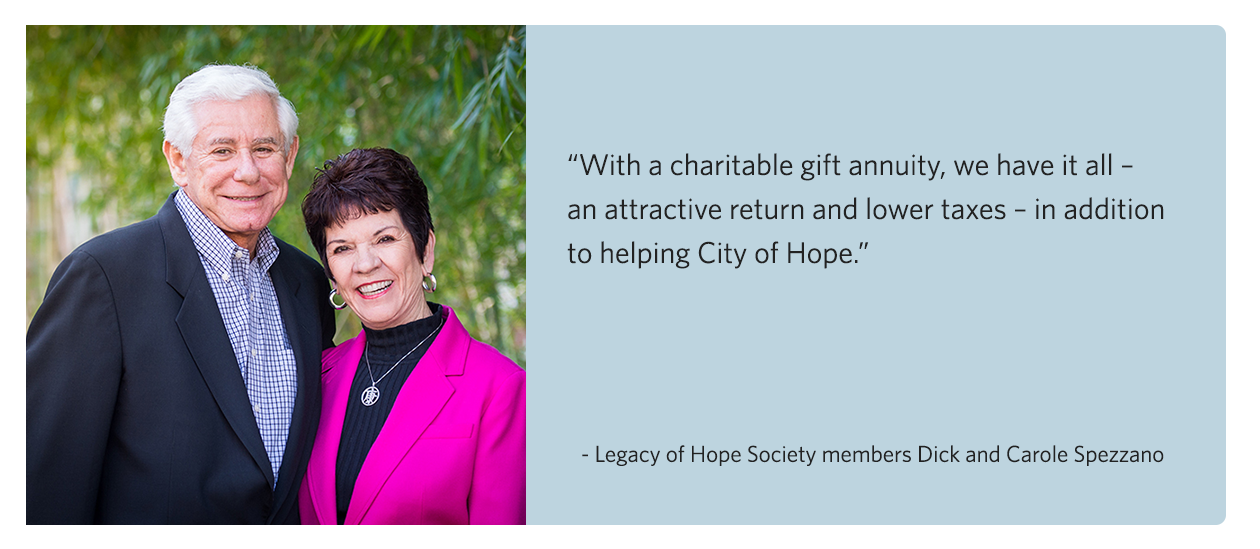

Read the Spezzano Story

Dick Spezzano and his wife, Carole, consider themselves doubly lucky. They have not been personally touched by cancer and they have had the good fortune to be touched deeply by their involvement with City of Hope. “It’s easy to appreciate what City of Hope does,” says Dick. “You see the results in lives saved.”

In the early days of his involvement with the Southern California Food Industries Circles, Dick contributed his time to City of Hope. As his appreciation for City of Hope — and his income — grew, he expanded his commitment to include fundraising. “At first, our industry was happy if we raised $20,000 for City of Hope. Now we’re raising close to $1 million annually,” he says, proudly.

“Carole and I believe in City of Hope,” Dick adds. “We’ve visited the campus numerous times and we both give blood and platelets. We’ve also looked closely at City of Hope’s financial reports. When you see how much money goes to support programs that help people — and not to administration — it’s really impressive.”

Carole, who has been by Dick’s side every step of the way, echoes his sentiments. “All our married lives, I’ve been a strong supporter of Dick and his work on behalf of City of Hope,” she says.

That is why the Spezzanos have stepped forward to lead the Southern California Food Industries Circle as part of the Industry Challenge to benefit City of Hope. The Spezzanos’ financial goal was to preserve their current assets. “We realized that when we die, we want our assets to make a difference,” Dick says. “So we considered a provision in our estate that would transfer funds to City of Hope at the death of the second spouse. Then we talked with our CPA, and he suggested that we might want to do something now, instead of waiting. With a charitable gift annuity, we could have it all — an attractive return and lower taxes — in addition to helping City of Hope.

“Each of us is in a different position financially and in our lives,” Dick continues, “but Americans are good about giving back to the organizations they’ve been involved with. I hope Southern California Food Industries Circle supporters will consider making a similar estate commitment to City of Hope.”

This information is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association.