Use this checklist to see if transferring real estate to a charitable trust is a good option for you. Would you like to:

If you answered “yes” to any of these questions, transferring your property to a charitable trust may be your answer.

Use the form on this page to request a complimentary example of your benefits. City of Hope’s Planned Giving staff are experts in facilitating the process for you.

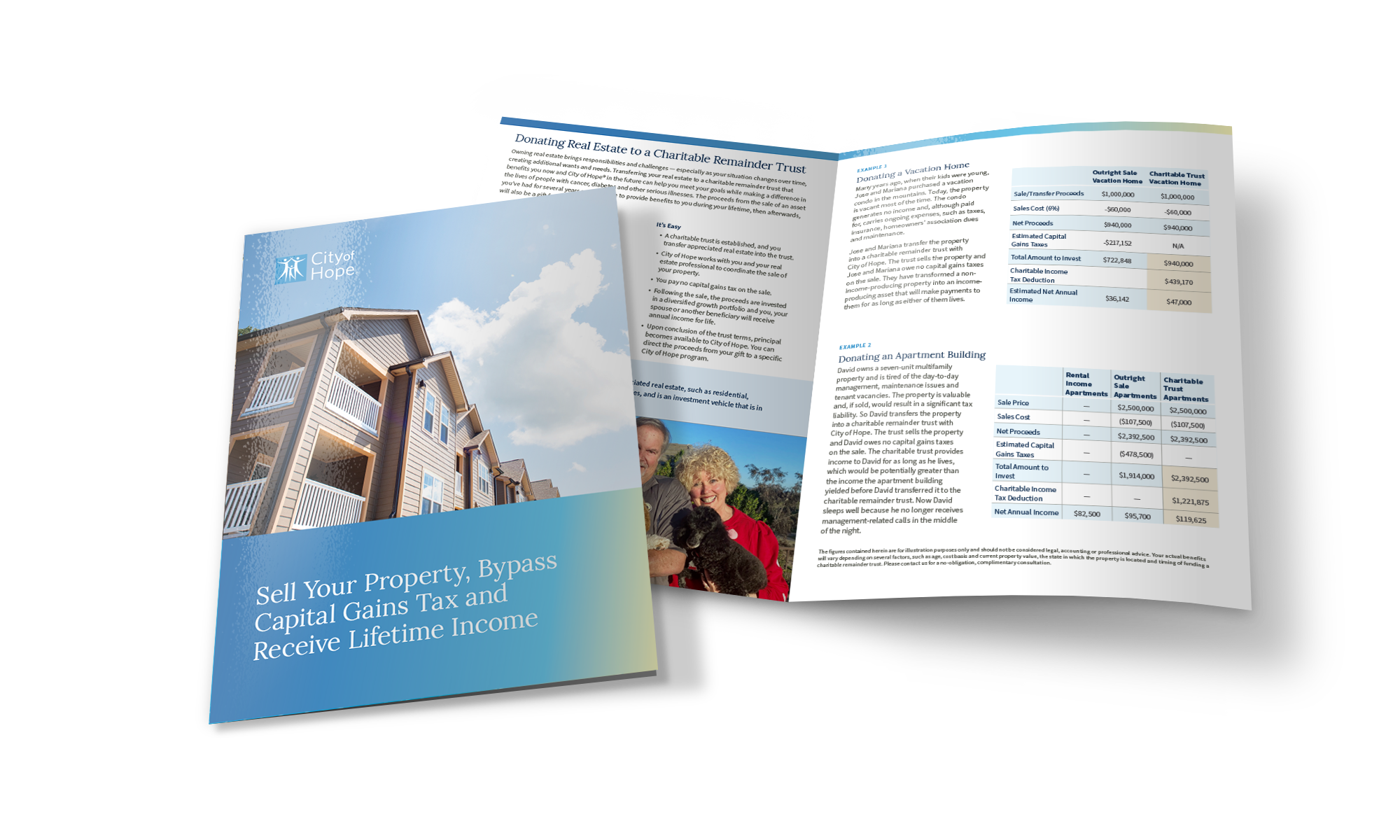

Income and Tax Deduction From Donated Real Estate Example:

| Apartment Building Rental Income | Apartment Building Outright Sale | Apartment Building Charitable Trust | |

|---|---|---|---|

| Sales Price | - | $2,500,000 | $2,500,000 |

| Sales Cost | - | ($107,500) | ($107,500) |

| Net Proceeds | - | $2,392,500 | $2,392,500 |

| Estimated Capital Gains Taxes | - | ($478,500) | - |

| Total Amount to Invest | - | $1,914,000 | $2,392,500 |

| Charitable Income Tax Deduction | - | - | $1,221,875 |

| Net Annual Income | $95,000 | $95,700 | $119,625 |

The figures contained herein are for illustration purposes only and should not be considered legal, accounting or professional advice. Your actual benefits will vary depending on several factors, such as age, cost basis and current property value, the state in which the property is located and timing of funding a charitable remainder trust. Please contact us for a no-obligation, complimentary consultation.

One Couple’s Story

Birdie and Bob Feldman were looking to simplify their lives, spend more time on their favorite pastime — boating — and have a charitable impact. They came upon the perfect solution. To demonstrate their support for City of Hope, they made a gift of real estate: an apartment building they bought as an investment years ago.

Birdie and Bob Feldman were looking to simplify their lives, spend more time on their favorite pastime — boating — and have a charitable impact. They came upon the perfect solution. To demonstrate their support for City of Hope, they made a gift of real estate: an apartment building they bought as an investment years ago.

With the support of City of Hope’s expert Planned Giving team, the Feldmans created a charitable trust, which enabled them to sell the property and avoid incurring capital gains tax on the transfer. The proceeds from the sale were invested, and the Feldmans receive an annual income that will continue for both their lifetimes, after which the remainder will be used to support lifesaving research and patient care.

“Forty years of being a landlord is enough. Even though we have a management company, being a landlord is very demanding. We want to be able to go on vacation without having to worry about the property … and spend more time on our boat than we are able to now. And we found a way to help people at the same time!” says Bob.