Many City of Hope donors want to do more to help City of Hope, but also want to make sure their loved ones, especially children and grandchildren are taken care of.

A Charitable Lead Trust

A charitable lead trust is a way of making a gift to City of Hope that enables you to reduce gift and estate taxes while controlling the timing of passing assets to your children and grandchildren.

You contribute securities or other appreciating assets to a charitable lead trust. The trust makes annual payments to City of Hope for a period of time. When the trust terminates, the remaining principal is paid to your heirs.

Benefits to You:

- The present value of the income payments to City of Hope reduces your gift/estate tax.

- All appreciation that takes place in the trust goes tax-free to your heirs.

- The amount and term of the payments to City of Hope can be set so as to reduce or even eliminate transfer taxes due when the principal reverts to your heirs.

- You have the satisfaction of making a significant gift to City of Hope now that reduces the taxes due on transfers to your heirs later.

A Gift Annuity with Two Beneficiaries

Charitable gift annuities are a popular way of providing financial security to a loved one. You make an irrevocable donation of at least $25,000 to City of Hope to create a gift annuity with two beneficiaries, for example, a spouse or adult child. You receive fixed annual payments — for as long as either beneficiary lives — at an attractive payment rate and a charitable deduction, too. Plus, you enjoy the satisfaction of making a gift that benefits you now and, in the future, helps fund innovative research and compassionate patient care.

Martin, age 79, wants to be sure that if something happens to him, his wife Eleanor, age 77, will be financially secure. He and Eleanor also want to help City of Hope so they donate $100,000 to create a gift annuity. The payment rate for two beneficiaries, age 79 and 77, is 6.2%, which results in an annual payment of $6,200. If either of them passes away, the surviving spouse will continue to receive the full $6,200 annuity payment each year for life.

A Charitable Remainder Trust

A charitable remainder unitrust with City of Hope can provide you and/or other beneficiaries with income for life or for a fixed number of years. For your donation, which can be appreciated securities or real estate, you receive an immediate income tax deduction for a portion of your contribution to the unitrust and savings on capital gains taxes, too. You will also have the satisfaction of making a significant gift that benefits you now and City of Hope later.

With this type of gift you can:

- Avoid paying capital gains on sales of appreciate stock and real estate.

- Convert the full value of your asset into a lifetime income stream.

- Receive a significant charitable income tax deduction.

- Remove assets from your taxable estate.

Joan and David, both age 70, have a vacation home that has become a burden to manage and maintain. Giving the property to one of their children is not an option. The property is worth $350,000, but they paid only $20,000 and are concerned about capital gains taxes. Donating the property to City of Hope would provide them with income, reduce their capital gains tax and enable them to reduce the estate tax bill their children will inherit.

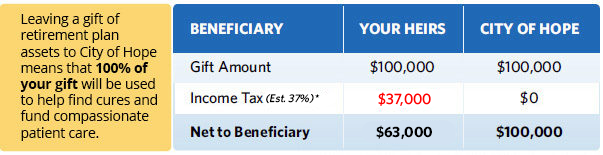

A Gift of Retirement Plan Assets

Because retirement plans are taxed differently than most assets, they may actually become a tax liability. Naming City of Hope a beneficiary of your retirement account can be an attractive option for leaving a legacy and reducing income and possibly estate taxes for your loved ones.

*Tax Rates shown here reflect 2018 tax law changes.

Estate tax is not shown because it applies infrequently.

Making City of Hope a beneficiary of a retirement account is easy. Simply ask your plan administrator for a beneficiary designation form and include City of Hope as the beneficiary of a specific percentage of the account value or as a contingent beneficiary.