You may be surprised to learn that there are a variety of ways to leave a lasting legacy that can be accomplished just by signing your name. There is no need to write out a check now — you retain full control of your assets for as long as you need them.

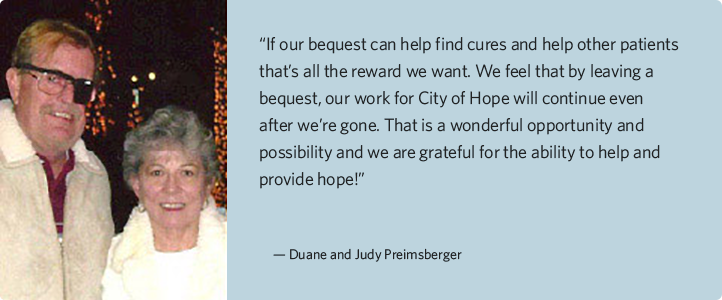

Bequests are a time-honored way of ensuring that your annual support of City of Hope continues for generations to come.

To leave the majority of funds to your loved ones, name City of Hope the beneficiary of a specific amount or percentage of your estate.

To leave City of Hope what is left after loved ones are provided for, use a residuary bequest. City of Hope will be “second in line” after all costs and bequests to others have been satisfied.

To leave your estate to family and friends, unless you outlive one of your beneficiaries, consider a contingent bequest. This is often used by husbands and wives who stipulate that if the other spouse is not living, then the bequest specified for that spouse will go to City of Hope.

Retirement Plan Savings

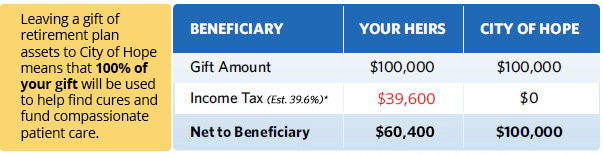

Because retirement plans are taxed differently than most assets, they may actually become a tax liability. Naming City of Hope a beneficiary of your retirement account can be an attractive option for leaving a legacy and reducing income and possibly estate taxes for your loved ones.

*Tax Rates shown here reflect 2017 tax law changes.

Estate tax is not shown because it applies infrequently.

Making City of Hope a beneficiary of a retirement account is easy. Simply ask your plan administrator for a beneficiary designation form and include City of Hope as the beneficiary of a specific percentage of the account value or as a contingent beneficiary.

Here is how to include City of Hope:

Life Insurance Policies

Many of us have life insurance policies that have long since served their purpose. Perhaps you purchased a policy to make sure your children’s tuition needs were accounted for. But now the kids are on their own and doing well. Or perhaps you have a policy your parents purchased for you years ago. These policies can make a wonderful gift to City of Hope.

- Request a beneficiary designation form from your life insurance company and make City of Hope a full, partial or contingent beneficiary.

- Sign over a fully paid policy. You will be allowed a tax deduction for your generosity.

Gifts of Savings Bonds

If you have savings bonds that have stopped earning interest, they may be a tax liability for you. If you redeem your bonds, you will owe income tax on the appreciation. Leaving them to loved ones means they will owe income tax when they cash the bonds and perhaps estate taxes, too. In the end, your heirs will receive only a fraction of the value of the bonds in which you so carefully invested.

Wouldn’t it be wonderful if you could these avoid taxes and give your savings bonds new life? Simply bequeath them to City of Hope. Because City of Hope is tax exempt, we will receive the full value of your savings. Just a single sentence in your will or living trust completes your gift. Here is how:

Bequests from a Donor Advised Fund

As with many financial accounts, final distribution of contributions remaining in a Donor Advised Fund is governed by the contract you completed when you created your fund. We hope you will consider naming City of Hope a successor of your account.

Or you can name City of Hope the successor for a portion of the account value, leaving the remaining portion for your children or grandchildren to continue your legacy of philanthropy.

Learn MoreGifts of Certificates of Deposit and Other Bank Accounts

Many City of Hope donors have assets — often overlooked — that make an ideal gift. These include certificates of deposit, bank accounts and brokerage accounts. These assets only transfer to City of Hope when you no longer need them and you can designate City of Hope as the recipient of the account proceeds simply by naming City of Hope as the pay-on-death or transfer-on-death beneficiary.